Check Stubs Tips & Hints

If you use online check stubs—a business choice being swiftly adopted around the globe—we have consolidated a few check stubs tips and hints that will hold you in good stead.

Identify the difference between contractors and employees

While generating pay stubs, be mindful of how your contractors—people who are not part of the payroll but hired on contract—will not be subject to regular deductions like employees. Fortunately, many quality pay stub makers available online will cater to this difference for you, bifurcating contractors and employees during stub generation.

Understand what each pay schedule means

Pay schedules, or the frequency/timelines as per which you get paid, differ across employees. When generating a pay stub, be mindful of the meaning of these terms:

Use enhanced pay stubs for detailed needs

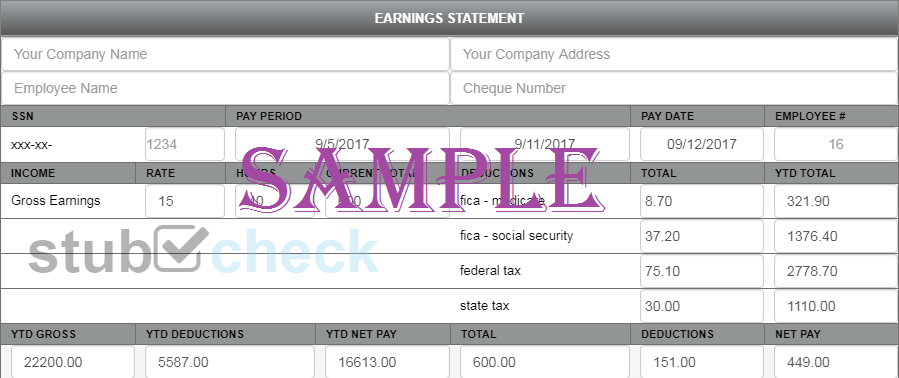

If you want your pay stubs to showcase your income from various buckets such as holiday/vacation pay and bonuses, you should choose an online tool that offers enhanced pay stubs. Such check stub makers frequently also show your deductions in careful detail, along with personal information like marital status. Extensive pay stubs can come in handy when you need to summarise your financial life for loan applications, insurance claims, or job negotiations.

Build Your Stub Right Now

This is a sample paystub. The watermark will be removed once you’ve made the payment.