Essential Information for a Compliant Pay Stub

For a pay stub to be legally valid and recognized as proof of income, a certain set of details must be included accurately. Compliance with your state’s laws is paramount.

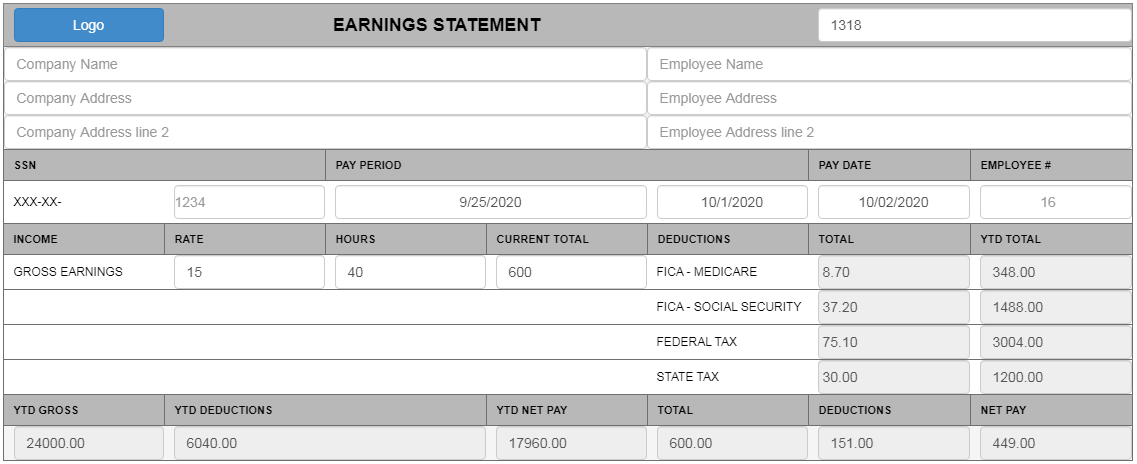

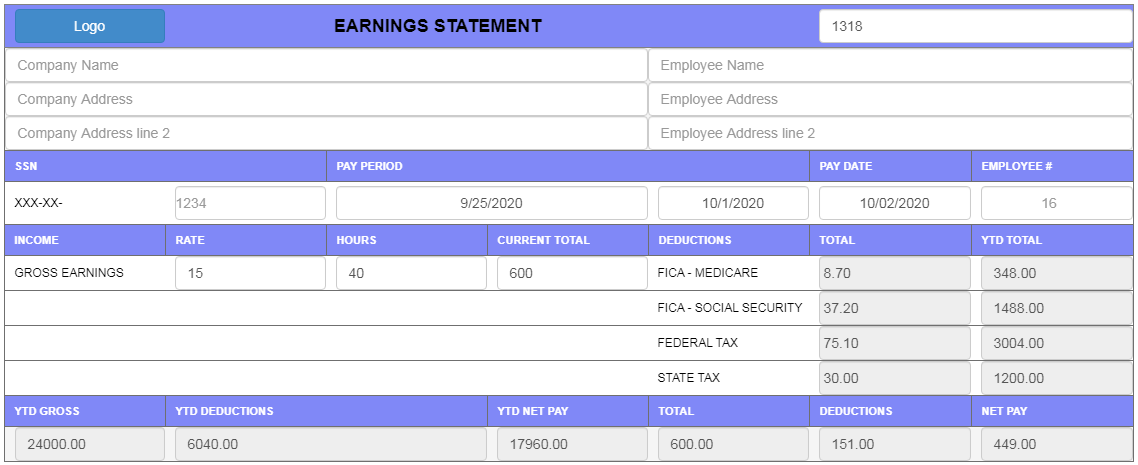

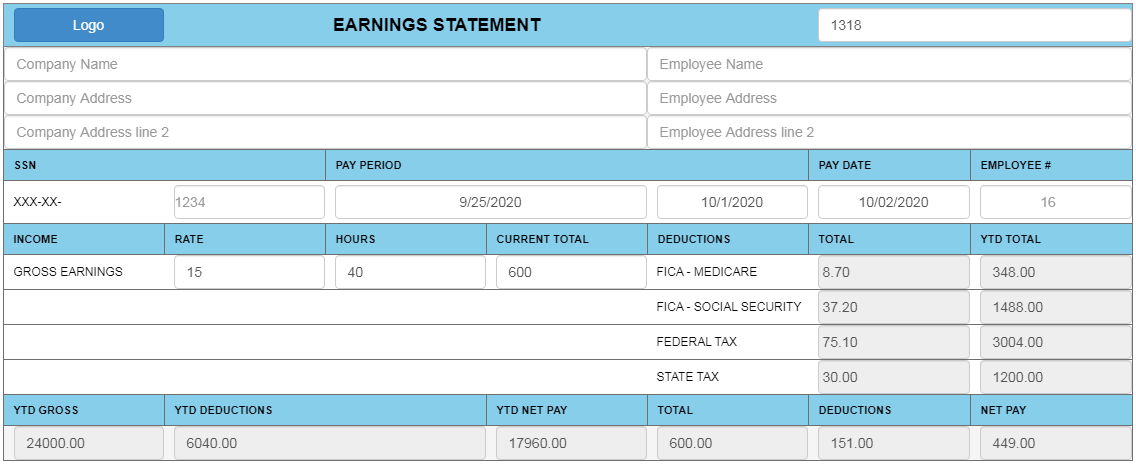

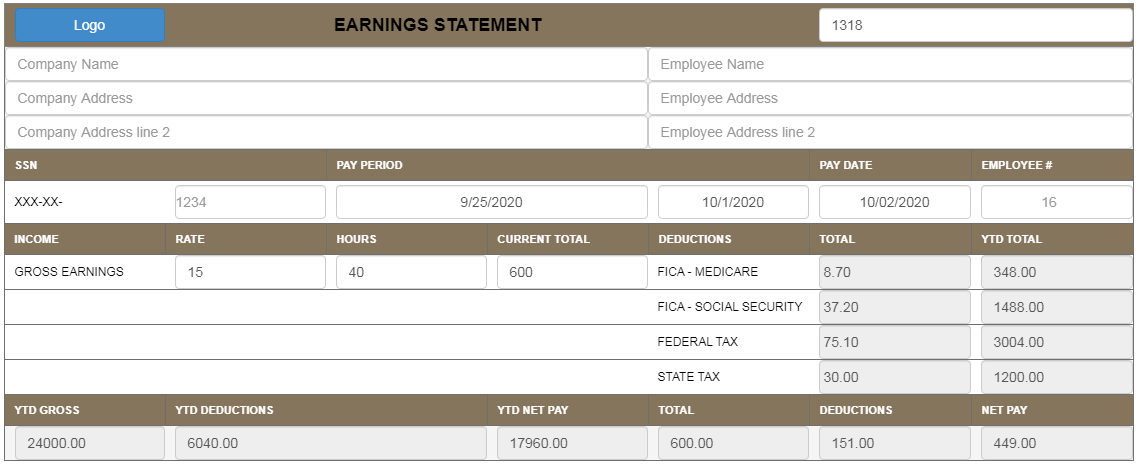

Ensure your pay stub contains these essential components:

- Company Information: Company name, contact information, and address should be provided along with any required license numbers.

- Employee Information: Minimum pay stub employee details must include full name, address, contact number, and ID number.

- Income Details: Gross pay, net pay, year to date (YTD) figures, and the date for the payment period must be provided.

- Deductions & Taxes: Federal and state deductions, including FICA, Medicare, and any local taxes, must be detailed. If your city mandates local taxes, include them.

Get Started Now

Avoid the hassle of calculating payroll and constructing complicated documents. Within minutes, using our professional pay stub generator, you will be able to make an accurate proof of income document.

Frequently Asked Questions (FAQ)

Q . Are these pay stubs legal and suitable for formal uses; for instance, applying for a loan?

Yes. Our templates have a professional finish and are designed to align with broad regulations. They may be used for formal situations, like applying for a loan or renting a house, if the information you provide is accurate and honest. You must check your state requirements as well.

Q . Is the pay stub generator really free or is there a catch?

You can create pay stubs through our system without having to pay. Our aim is to offer a free and simple service for generating professional documents.

Q . How does the pay stub generator make sure deductions and taxes are accurate?

The generator performs the complex calculations that you in your business will have. Our accountants do all the calculations in-house which guarantees you a document with zero errors.

Q . What information is necessary to include in a pay stub?

You need to include information about the business (name, address, and contact information), the employee (name, address, and identification), the compensation (gross pay, net pay, year-to-date total pay, total pay for the specified period, and the pay period dates), and all taxable deductions (Federal, State, FICA and Medicare) must be included as well as the YTD totals.

Q . Customization of pay stubs?

Absolutely. Although the core information must remain the same in order to provide the necessary information for legal and tax purposes, there is a wide range of designs to choose from, in case there is a need for specific business colors or to match the theme of the business functions, as well as various combinations of paper (standard printing, business checks, etc.). Finally, there is a place for company logo and other design details.

Q . Method of receiving a pay stub?

After entering the appropriate information, the system immediately prepares the document and sends it as a pdf attachment for printing, as well as other electronic options such as sending it via email.

Absolutely. It is critical for self-employed people that all self-paid documented stubs be in order to form a legally compliant record and all necessary self-employment documents. Our document tracking system is integrated, making it easier to manage expenses and profit tracking. Also included are the W 2 form and 1099 forms as well other self-employed helpful documents.