123 Paystub Generator - Create professional paychecks online

Paychecks stubs are proof of income. Pay stubs are show income summary with benefits, deductions, and help keep track of employee hours. It is used by employers and employee as poof of income for loans or apartment rentals.

123PayStubs is a great option for small business owners and sole proprietors to be able to create professional pay stubs on the go.

Build Your Stub Right Now

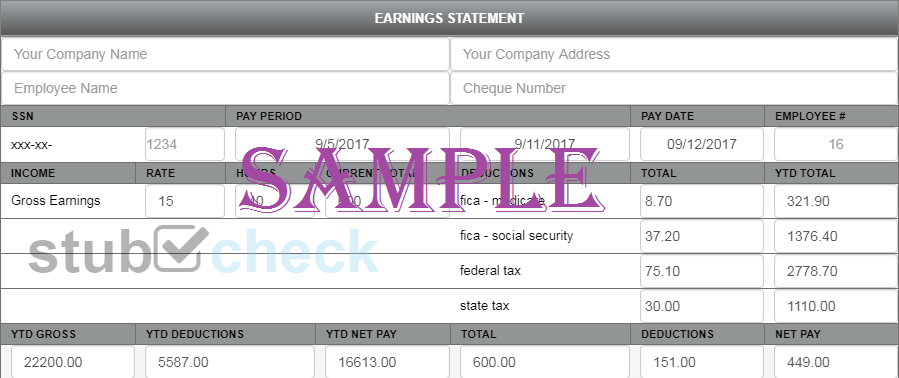

This is a sample paystub. The watermark will be removed once you’ve made the payment.

What is a paystub or a check stub ?

Check stub or paystub is a document that summarizes an employee’s gross pay, net pay, and the tax deductions. It is significant for employees and employers as it is proof of income, shows that all taxes have been withheld, and certifies taxes have been paid for. If immigration or government benefits are being applied for, it is helpful in verifies employment. It also tracks employee earnings to help them fill out income tax forms to file.

The stubcheck mobile responsiv has made it easy to create accurate paystubs for sole proprietors and small business owners. With the app, owners receive automated calculations for federal, state and local withholding taxes, as well as FICA taxes (social security and Medicare). They have the flexibility to customize the 123paystub template to their company’s branding and can view and download their paystub in three easy steps. With accurate year to date (YTD) calculations, the app further simplifies the process for the employer and the employee.

How Do Users of 123 Paystub Checkstub Creator Benefit from Us?

123 Paystub provides accurate paystub generation for small business owners, employees, contractors, and self-proprietors with the most accurate and easy to use self-service technology. With the app, owners save time on calculating withholdings for Federal and State taxes, FICA (social security and Medicare) taxes individually for each paystub. Our app also allows owners to save time and avoid penalties by sending timely notifications for payroll tax due dates and year-end information returns filing due dates.

Users can modify paystubs by inserting their company logos, company name, and company address on the paystub. A detailed summary of each employee’s gross pay, net pay, and other deductions is also provided. Paystubs can be printed, saved, and sent as PDFs to employees, who can also receive e-letters. It also gives employees numbers to Withholdings and FICA to help them compute their taxes and deductions during the year.

Employers have to remit to the IRS employment taxes on a periodic basis after each payroll. Depending on their overall tax liability, deposits can be scheduled on a semi-weekly basis or monthly. The system can provide reminders of deposit deadlines to help manage them on a semi-weekly or monthly basis and can assist in the transactions by pre-filling information from paystubs generated in 123PayStubs. It can even provide electronic filing of Form 941, Wage and Tax Statement, Form 1099-MISC, Non-employee Compensation, and other documents directly from the system, when needed.

Most of our professional templates allow you to generate self-employ paystub templates in bulk within seconds. All the user would need to do is insert the desired paystub date along with other employee information, and hundreds of paystubs would be created within seconds, including self-employment income paystubs. Besides providing proof of income, paystubs can be used to record payments made to independent contractors, which helps with quarterly taxes, offers payment proof, and saves self-employed individuals time.

One of the most important features to look for in a paystub solution is the ability to automatically calculate Federal and State tax withholdings, as well as FICA taxes. Your employees will need to be confident that all of the appropriate amounts will be withheld every time a payroll is processed. This is a very important consideration for you since they need to be confident that you will withhold and report payroll tax obligations every time you file your payroll tax returns at the end of the year. 123PayStubs makes and withholds the taxes to eliminate any uncertainty for your employees and to make all of this as easy as possible for you.

Another great feature is that it can assist you in filing your business's IRS year-end forms. 123PayStubs can directly retrieve the necessary data from the pay stubs you generate to complete these forms. This saves you time, as you don't have to manually input the data into the IRS e-filing system. 123PayStubs contacts you directly in case you need to make tax deposits and derives these tax deposits from within the application to help you with your deadlines.

A 123 Paystub Generator Made For You

If you are an employer looking to simplify the process for your employees in understanding their earnings and deductions, or you're an individual that needs income verification for loans or apartment rentals, our paystub creator is for you. All you have to do is enter the relevant employee or company information, and you can make a pay stub for free in just a few clicks.

Employers facing issues when filing taxes implies mistakes have occurred. Incorrect tax amounts, especially over or under withholding, lead to issues. Our 123 Paystub maker calculates FICA taxes, state and federal tax withholdings, and year-to-date figures to ensure compliance.

There is peace of mind when employees can generated paystubs to retain necessary documents to present to lenders or landlords. Paystubs help to outline income and track deductions, and also alleviate worries around pay discrepancies. Independent contractors especially appreciate paystubs, as they help provide evidence of client payments or outstanding invoices.

Frequently Asked Questions (FAQ)

1. What is a paystub, and why is it important for employers and employees?

Ans : A paystub, or paycheck stub, is a legal document that summarizes an individual's gross pay, net pay, and a detailed breakdown of all tax and benefit deductions for a specific pay period. It is important because it:

- • Serves as proof of income for employees and contractors when applying for loans, renting an apartment, or applying for government benefits.

- • Ensures compliance by showing that an employer has withheld and remitted all required Federal, State, and local taxes.

- • Helps track earnings and deductions throughout the year for accurate income tax filing (W-2s/1099s).

2. Who is the 123 Paystub Generator designed for?

Ans : The 123 Paystub Generator is designed for:

- • Small Business Owners who need to provide accurate, professional pay stubs to their employees without investing in expensive, complex payroll software.

- • Sole Proprietors and Independent Contractors who need compliant pay stubs to serve as proof of their self-employment income for financial verification purposes.

- • HR Teams and individuals looking for a fast, reliable tool to manage basic payroll documentation.

3. How does 123PayStubs ensure the accuracy of tax calculations?

Ans :Our system is designed to eliminate common manual errors. The 123 Paystub Generator automatically calculates all necessary tax amounts, including:

- • Federal income tax withholding.

- • State and local income tax withholding.

- • FICA taxes (Social Security and Medicare), using the latest wage base and withholding rules. • Accurate Year-to-Date (YTD) totals for all earnings and deductions.

4. Can I customize the paystub template to match my company's branding?

Ans :Yes. Users can easily customize their 123PayStubs template. You have the flexibility to:

- • Insert your company logo.

- • Include your company name and address.

- • Choose a template design to match your company’s professional appearance.

5. Does 123PayStubs assist with payroll tax filing and deposits?

Ans :Yes, 123PayStubs provides features to help simplify year-end compliance and tax deposits:

- • The system can send timely reminders for semi-weekly or monthly payroll tax deposit deadlines based on your liability.

- • It can facilitate the filing process by pulling data directly from the pay stubs generated in the solution.

- • It can assist with the electronic filing of year-end information returns like Form 941 (Employer's Quarterly Federal Tax Return) and Form 1099-MISC (Non-employee Compensation), whenever applicable.

6. Can I use the 123PayStubs solution on my phone?

Ans :Yes, the 123PayStubs mobile responsive easyly to open any mobile, making it easy for small business owners and sole proprietors to create accurate, professional pay stubs on the go in three simple steps.