How Regular Paystubs Help You Build a Strong Financial Profile in the U.S. 2025

To obtain services such as loans, rentals, credit cards, and insurance, a solid financial portfolio is required. Most people think only about credit scores, however, crystalline and consistent income documentation is another very important piece. In America, paystubs stand among the strongest instruments for establishing financial credibility.

Regular paystubs, whether for a job as an employee or a self-employed individual, help to foster trust, transparency, and financial stability.

What is a financial profile?

A financial profile is made up of a number of elements, as listed below:

• credit score

• income consistency

• debt to income ratio

• loan history

• employment history

• history of payment

Earnings loss history documentation strengthens several of these elements.

Why Regular Paystubs Are Important ?

Paystubs reflect your financial behavior and income patterns month after month. When lenders, landlords, or agencies check your profile, they review whether:

- you have consistent earnings?

- your income is stable over a period of time?

- do your pay history and bank deposits align?

- Are your tax required deductions present?

Regular paystubs facilitate this appraisal.

There are Ways Pay Stubs Benefit Your Credit Applications

There are trends with credit card companies and lenders regarding strong income documentation and regular pay stubs:

• They support higher credit limits

• They assist with obtaining approvals on loans in a timelier manner

• They increase lender confidence in your ability to pay bills

• They alleviate the necessity of additional documentation

Better interest rates are traditionally awarded to applicants with complete documentation as well.

How Spends Stubs Benefit Your Rental Applications ?

30–60 days of consistent pay stubs are a common requirement by lenders. Some of the things that consistent pay stubs demonstrate include:

• Evidence of long-term employment

• Evidence of financial ability to pay rent

• Evidence of financial reliability

Documented income applicants are usually approved more quickly and experience fewer inquiries.

The Extraction of Payment Stubs From Freelance Work

Freelance employees do not earn a stable income pattern due to;

• Incomes of Freelancers can be of varying amounts

• Receivables can be of multiple sources

• Self Emt Tax Withholding incurs is not certain.

• Irregular income Individuals are considered by Financial institutions as high risk.

By freelancers creating monthly pay stubs, they can establish a pattern of income, and can be able to access resources that would otherwise be difficult to obtain as follows;

• Loan

• Housing

• Insurances

• Credit Facility

• Financial Assistance from the Government

Freelancers can access the aforementioned resources thanks the monthly income pattern they have been able to establish.

How Paystubs Help With Tax Regulatory Compliance

Pay stubs help freelance employees track earnings owed to them, as well as any

• Income Tax that has been withheld

• Social Security and Medicare Contributions.

• Retirement Contribution Deductions

• And other Deductions

And if the pay stubs are track as they should, This also means that they will have less of a risk of being audited.

By understanding the financial awareness of the freelance employee, pay stubs help create a pattern of;

• Income Earned

• Variable Outgoings

•Deductions

The ends made and the income earned gives the freelancer a financial discipline, a more structured lifestyle, and awareness of the financial discipline.

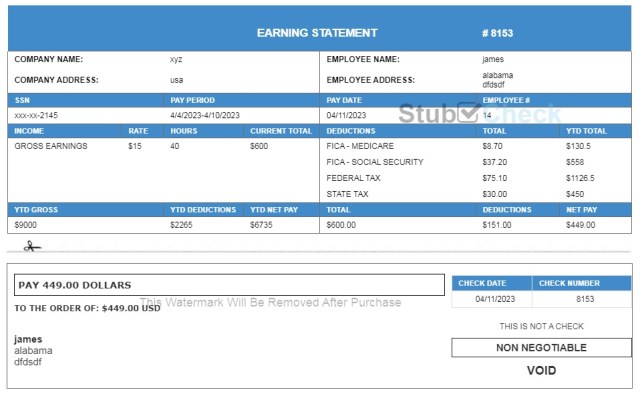

How Stubcheck Helps Financial Profiles

Users of Stubcheck have the ability to;

• Paystubs are generated for them.

• Paystubs can be saved in bullet points by month

• Financial Year documents can be saved.

• Users will be able to use the stub as a form of pay expense proof.

This will help improve the credibility of the users financially as they will provide proof of income.

Final Thought

In the US, having an employment history corroborated with regular pay stubs is invaluable when it comes to having a robust financial profile. It makes your applications to creditors and renters, tax files, and financial credibility more robust. If you are self-employed, have regular pay stubs and you are likely to secure competent financial instruments and make your financial life more manageable.

FAQ

1. In what way do pay stubs enhance financial credibility?

Having pay stubs provides you with a record of employment and credibility when it comes to your income. Particularly in the US, as a borrower, having pay stubs is a necessary requirement when applying for a job, rental, or loan, as it proves you have a source of income. Potential employers and lenders need to see pay stubs in order to make a risk assessment of your financial situation. Most employers request pay stubs to determine your financial reliability. If you have a history of keeping pay stubs, it is likely to enhance your credibility.

2. Do Freelancers Need Monthly Paystubs?

As a freelancer, you are not obligated to create pay stubs every month. However, for some, having paystub records helps for various reasons. For lenders and institutions, pay stubs are a quick and simple way to show what you earn and they can provide proof of monthly income for freelancers. Generating pay stubs with accounting software can help freelancers keep track of their monthly income for financial planning or tax records. Having monthly paystubs can help freelancers with their finances and simplify their finances with loans.

3. How Often Should Paystubs Be Created?

This depends on how often you get paid. For most employees, a paystub is generated every time they get paid and for freelancers, they can create a paystub every month or each time they get paid. However, to keep your finances organized and easily track what paystubs you have, it’s best to set a consistent time of month to create paystubs. Doing this helps provide accurate records to lenders, institutions, and for your own financial planning/future tax filing.

4. Could paystubs increase chances of gaining credit approvals?

Pay stubs can positively impact credit approval chances. Lenders utilize pay stubs to assess income and ability to pay back loans and other forms of credit. Having stable employment and consistently earning the same amount each pay period is financial stability, which is a major factor when lenders are making credit decisions. Including pay stubs with an application demonstrates reliability as a borrower which can yield credit approvals with more favorable terms; lower interest and higher amount of credit available are both very common.

5. Is an institution likely to view paystubs generated online as professional?

As long as online generated pay stubs are professional, accurate and verifiable, they can be seen as reliable. In the United States a large amount of employees, freelancers, and small business owners use online generators to create pay stubs that meet the requirements of lenders and employers. To ensure they are seen as reliable, all pertinent details should be included; your name, employers name, a breakdown of your income, and the period the income is from. Documents like bank statements and tax forms may be used to confirm the pay stubs are professional and accurate.