Understanding the Pay Stub and Its Deduction Codes

At the end of every pay period, you look at your pay stub, and it is bright and shining with all of your gross earnings, but then all of the sudden the pay stub has all of the salary deduction codes and the amount due and the bright sting of gross pay has turned into a much smaller amount due net pay amount. What do all of those codes mean, and why does the gross amount look so good compared to the net amount due? What you see in codes, in deductions, and codes in paycheck stubs is a reflection of some of the salary deductions taken out of your wages for taxes, medical benefits and other withholdings, payroll advances, and unpaid sick/personal leaves. Knowing exactly what all those codes in your paycheck mean is the only way to 100% ensure that you are being paid the right amount correctly.

This guide aims to end your confusion and help you to understand what those salary deduction codes mean, how to read your pay stub and understand it, how to verify what the salary deduction codes mean and help you to understand what the most commonly used salary deduction codes are, so that you are able to read your pay stub salary deductions with the fullest amount of assurance so to eliminate the possibility of being underpaid.

What are Salary Deduction Codes?

Salary deduction codes are short, randomly generated, and in some cases, numeric, passwords, letters, and numbers assigned to each of the salary deductions and other codes, and salary deduction codes are used by payroll systems to indicate and divide each of the wages into each of the salary codes in a salary stub. Instead of spelling out the entire salary deduction for the retirement plan, codes like 401(k) retirement plan would instead be stated as 401k or instead of spelling out \”federal wages earned for the pay period\” it would be shortened to FIT” or other. So instead of spelling out federally mandated payroll taxes as FIT, it would instead be stated as FIT. So as a result of the salary deduction codes and salary codes and division assigned to each payroll deduction and withholdings declared on stubs, pay stubs would be that much more concise.

Keeping accurate records of your financial transactions is important for both you and your employer. Employee records provide a trail of all financial transactions related to money that is received by an employee and employee expenses, including required tax payments to the government and optional employee benefit plan payments. For an employer, employee records serve the purpose of tracking employee compensation, including compliance with the employer’s obligations under the law as to the federal and state government.

How To Verify Your Deductions on a Pay Stub ?

Assessing your expenses that you have had to pay in the past is an ingredient to successful financial management. Your pay stub is a financial record that documents all expenses that you have incurred in order to help employee benefit decisions, voluntary branch payments, and retirement contributions.

To assist you in confirming the accuracy of your deductions, the following is a guidance to help you conduct your review in a methodical manner.

1. Obtain Your Pay Stub: You can either download your most recent pay stub right now using your company’s employee portal, or you can obtain a hard-copy pay stub.

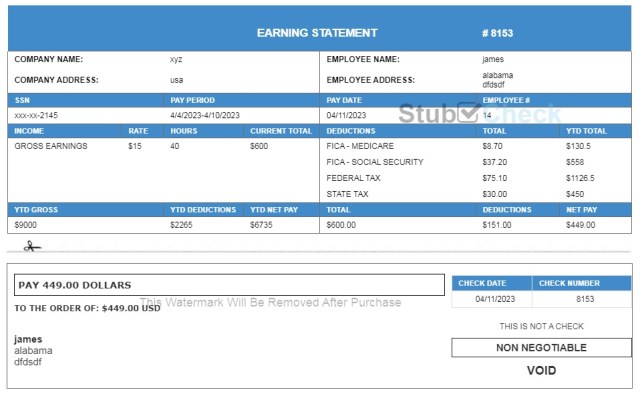

2. Locate the Deductions Section: Find the area on your pay stub that lists deductions. It’s often broken down into columns showing the deduction code, a brief description, the amount for the current pay period, and the year-to-date (YTD) total.

3. Cross-Reference Your Elections: The selected health insurances, dental care, and retirement plans, and benefits deductions, are explained in the documents employment paperwork you signed during your orientation and new hire training or during the open benefits enrollment period. Are the amounts consistent with your selections?

4. Review Tax Withholdings: Verify your state and federal tax withholdings. These should align with the data you’ve submitted in your W-4 form. If the figure is disproportionately high or low, you should verify and probably revise your W-4.

5. Question Unfamiliar Codes: If you notice a code you’re unfamiliar with, it’s important not to disregard it. Document it and request clarification from your payroll or HR departments.

Common Deduction Codes And What They Mean

While some of these codes are specific to your employer, a lot of them tend to be the same from employer to employer, and even nationwide. Below are some common deduction codes that you may find on your paystubs.

Deductions Codes for Social Security, Medicare and FICA

These are payroll taxes that you are required to pay because they fund specific federal programs.

• FICA: Federal Insurance Contributions Act. FICA is not a single deduction, it is a law that requires social security and Medicare taxes be deducted. Your paystub may simply state “FICA” to summarize the two taxes.

• SS, SOC, OASDI: All these codes relate to Social Security tax. OASDI means Old-Age, Survivors and Disability Insurance. For the year 2025, the tax rate that employees must pay is 6.2% with a cap annual wage base limit of $177,700.

• MEDI, MWT: These codes relate to medicare tax. For all earnings, the tax rate is 1.45%. Additionally, high wage earners may see an “Addtl MEDI” deduction, which is an extra 0.9% Medicare tax on earnings beyond a certain level.

Deduction Codes for Federal Income Tax and State Taxes These tax withholdings depend on your income, your filing status, and the allowances claimed on your W-4 and state tax documents.

• FIT, FITW, FWT: Federal Tax Withholding. This is the amount of your paycheck for which your employer withholds federal tax and is based on your W-4.

• SIT, SITW, SWT: State Tax Withholding. This is the amount of state tax withheld. The code and amount may differ based on the state in which you work. Some states do not have an income tax.

• Local, City, County: These are also codes for local tax, which may apply to you based on your work and residential location.

Benefit, Insurance, and Retirement Deduction Codes

These codes are related to voluntary deductions for the benefits you have selected.

• INS, MED, HLTH: Premiums for medical or health insurance.

• DEN, DENT: Premiums for dental insurance.

• VIS, EYE: Premiums for vision insurance.

• 401K, 403B, ROTH: Contributions to retirement plans. “401K” is for private sector, “403B” is for the non-profit sector, and “ROTH” means a post-tax retirement contribution.

• HSA: Health Savings Account. Pre-tax dollars are deposited into an account to be used for medical expenses.

• FSA: Flexible Spending Account. Pre-tax dollars are contributed for medical expenses (HC-FSA) or and for expenses related to the care of a dependent (DC-FSA) .

• LTD, STD: Long Term and Short Term Disability insurance.

• LIFE: Premiums for group-term life insurance.

What are Pre-tax Deductions, and Post-tax Deductions?

The distinction between pre-tax and post-tax deductions is important to fully understand what taxable income is.

Pre-Tax Deductions: These are dollars withheld from your gross pay before income taxes are calculated. This lowers your taxable income, and consequently you pay less taxes. Typical pre-tax deductions are health, dental, and vision insurance premiums, HSA/FSA contributions, and contributions to a traditional 401(k).

Post-tax deductions :are amounts that are taken after all applicable taxes are withheld and do not impact your taxable income. For example, a Roth 401(k) contribution, wage assignments, and union dues.

Examples of Common Mistakes in Deduction Code and Their Solutions

There are potential errors in the pay stub; knowing what to look for will hopefully prevent you from encountering problems in the future.

Wrong Code Assigned to a Deduction

An employer could code the vision insurance expenditure as dental and create an accounting error.

Solution: notify your payroll or HR department, and they will be able to fix the error in coding and make the adjustments for future pay periods.

Tax Withholding Code Error

This happens when data from your W-4 is scanned and entered incorrectly, resulting in excessive or insufficient tax being withheld.

Solution: you must review the W-4 elections you made and compare their content to the pay stub. If there is a difference, you will have to complete a new and corrected W-4 for your employer.

Garnishment Code Problems

There could be an inappropriate application of a wage garnishment (GARN) for child support or an unpaid debt, or the garnishment may not be lifted after the debt is paid.

How to Fix It: contact your payroll department as soon as possible over issues like these and be as detailed as you can about the issue. You might have to send documentation to the correct department in the court order or creditor to have the issue resolved.

Double Deduction Code Entries

From time to time and due to a system glitch or issue, a deduction like the 401(k) contribution might be taken out more than once in a given pay period.

How to Fix It: Let the issue be known to payroll as soon as possible. Payroll should be able to reverse the withdrawals and reimburse you on your next payroll, as a general rule.

Unclear Internal Code

Some companies build their own codes and those can be somewhat out of the standard leading to more confusion on pay stubs than there should be (especially if you have switched jobs recently).

How to Fix It: Asking the HR department for a codebook or a table of deduction codes and what those codes refer to can solve some referential issues.

System Error or Tax Table Out of Date

Taking the latest published tax withholding and tables is important when being updated for payroll systems. Otherwise, the state’s and federal tax tables will be inaccurate. It is important to keep the tables updated on a regular basis.

• How to Fix It: This is a systemic issue your employer must resolve. It is in your best interest to raise concerns regarding suspected incorrect tax withholding so that your employer can engage in a more thorough investigation of their programs.

To Sum It Up

Your pay stub is more than just a proof of payment; it is also your report card that reinforced payment. The deduction lines on your pay stub indicate that there are codes in that report that require translations. Once you learn to interpret your pay stub report, you will have control in managing your finances and making sound choices in your savings and benefits. It will also assist in validating the accuracy of your finances. It is always in your best interest to review your pay stub and do not shy away from payroll or HR inquiries.

Frequently Asked Questions

Who decides the deduction codes?

The deduction codes are determined by the employer in conjunction with the payroll software providers. Although there are generic codes that are used for taxes and other benefits, it is common for companies to use their own codes for customization.

Can a pay stub creator help with deductions?

Yes, and that is the purpose of a good pay stub creator. It removes the complexities from the employer to also perform the deductions, as the software will automate all necessary deduction codes for the employer, such as FICA, federal and state withholding, and other mandatory taxes, so that the employer’s info is simplified.

Where can I report errors in deductions?

You should always report issues the moment they come to your attention to your company’s payroll or human resources (HR) department.

Where should I go to learn about the deduction codes on my pay slip?

HR is the ideal answer to this question. They can provide you with a complete list of all deduction codes used at the company and their explanations.

What can I do if I see a mistake in my deductions?

You should reach out to your HR or payroll department right away. Please provide a copy of your pay stub to them and state the error. Reporting errors is always useful as it will help them get fixed.

Where on my pay stub will I find the deduction codes?

You should be able to find deduction codes in a specific area on your pay stub. This is usually in a separate column on the right side next to some description of the deduction and the amount that has been taken out.